Every four years we have a presidential election where the Republican, Democratic, and Libertarian Parties each come together to choose a candidate to present their solutions to our problems and represent their platform. Often times Republicans and Democrats have different ideas of how to address issues, like healthcare and taxes. Whereas the Libertarian party tends to have a little of both. Americans listen to each of their proposals and then head to the polls on Election Day to choose the next President of the United States. Our democracy is wonderful, but it works best when voters are educated on the candidates. Thus the Triumph’s Election Special 2016: HR and Benefits.

While there are traditional stances on many issues for both the Republican and Democratic parties, there are also times the candidates part from the traditional stances, which is why it’s so important to know the candidates and where each of them stand on the issues. You may be surprised to see they don’t always match the traditional party platforms. This year is certainly an unusual election year.

According to a national PNC survey conducted this fall, 65% of business owners aren’t happy with how either of the presidential candidates are handling business issues. We’ve spent some time doing our research to find out what each of the candidates are saying about some of the most important issues related to human resources and employee benefits and compiled what we’ve found to bring you as much information as possible to answer the question, how will the 2016 election affect human resources?

Regardless of which candidate you support or how you feel about politics, it’s important to understand the impact the election of a candidate can have on your work as a finance or human resources professional and on your benefits package as an employee.

For example, the Affordable Care Act provided a whole new set of paperwork and regulations for human resources professionals. Whether you believe this healthcare plan was positive or negative, the fact remains that the impact on your work and employee benefits were changed.

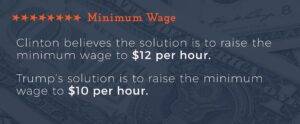

Minimum Wage

The minimum wage is a constant point of contention in elections. There are technically two minimum wages — a federal minimum wage and a state minimum wage. Basically, the federal minimum wage sets the bare minimum, and then the states are charged with deciding whether or not that minimum wage works well for the cost of living in their state. If it doesn’t, states may raise their minimum wages. While both minimum wages may be discussed, it’s often the federal minimum wage that is highlighted during presidential elections.

There are two sides to this issue. First of all, people working in minimum wage jobs for a significant amount of time are having a hard time being able to afford their basic costs of living. Second of all, businesses’ bottom lines are significantly impacted if/when they’re raised, which can result in a large number of layoffs and price increases on whatever products or services that business offers. It can also mean international production becomes more appealing, leaving some production to leave the United States.

Here are the candidates’ stances on the issue:

- Hillary Clinton believes the solution is to raise the minimum wage to $12 per hour.

- Donald Trump’s solution is to raise the minimum wage to $10 per hour.

This year, both candidates want to raise the federal minimum wage, but the difference is in the amount. While raising the minimum wage often happens over a period of time to lessen the blow on businesses, it’s definitely something to be aware of as you consider the impact on your business and your job.

Overtime

Whether or not the Fair Labor Standards Act overtime rule lives or dies will likely be decided in this election. Currently overtime is paid to employees who are not exempt and make less than $23,660. Those who are exempt do not get paid for overtime hours — that is hours they work in addition to their 40 hours per week. However, the Fair Labor Standards Act overtime rule was recently updated, significantly increasing the exempt salary threshold from $23,660 to $47,476.

That means if your business has exempt employees who make less than $47,476, you have to choose between giving them a raise to put them over that salary benchmark, or start paying them overtime. It also includes an automatic threshold increase every three years. This rule is set to take effect December 1, but the United States House of Representatives has already passed a bill, Regulatory Relief for Small Businesses, Schools and Nonprofits Act, which would delay the effective date six months to June 1, 2017. Regardless, you should be prepared by December 1.

While the financial aspect of this rule is substantial, overtime has additional implications for your human resources department. To pay overtime, you also have to track all of those additional hours and/or work. It’s a lot of additional administrative hours and could be expensive, especially for businesses in areas where the cost of living is low, and salaries aren’t as high.

Here’s what the candidates think:

- Clinton supports the rule wholeheartedly. If Clinton wins, the rule will likely continue throughout the new year without any interference.

- Trump supports the rule, but with a small business tax exemption, as the burden of increasing salaries and/or keeping track of and paying overtime would be more burdensome for businesses.

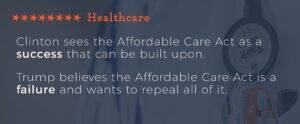

Healthcare

One of the biggest questions is how will the 2016 election affect my health benefits? As we alluded to earlier, the impact of the Affordable Care Act on human resources professionals has been significant. All of the new regulations not only require a variety of new reporting time commitments, but also financial commitments in offering healthcare to all full-time employees — defined as employees who work an average of 30+ hours per week.

Much of this year’s election conversation as it relates to healthcare is focused on the Affordable Care Act, which has the greatest impact on your business and your benefits as an employee. In this case, the two candidates differ. Because healthcare has such an impact on businesses, we’ve also included the vice presidential candidates’ views as well, so you can see the whole picture when it comes to healthcare.

- Clinton sees the Affordable Care Act as a success that can be built upon. So, how will Hillary winning the election affect your benefits? She wants to expand Obamacare to include a public purchase option and even offer health care to immigrants regardless of their status. In addition to expanding Obamacare, she wants to make it more affordable. She also wants to penalize companies for their markups on prescription drugs. Within her expansion, she has included a perk for businesses with up to 50 employees. Businesses of this size would be eligible for a healthcare tax credit with a simplified eligibility rules in an effort to make it more affordable for businesses, too.

- Tim Kaine, Clinton’s running mate, also praises the Affordable Care Act as a step in the right direction. His primary focus is on prevention. He believes that more should be done to encourage preventative care instead of what he refers to as “defensive medicine.”

- Trump believes the Affordable Care Act is a failure and wants to repeal all of it. So, how will Trump winning affect your benefits? In its place, he wants to develop a system for insurance that is based on free market principles, for those who want insurance coverage — he doesn’t want it to be requirement.In his plan, people would be allowed to use Health Savings Accounts (HSAs) and could purchase insurance across state lines, opening up the competition with the goal of decreased costs. He also sees a problem with the cost of prescription drugs and would also open up our borders to purchase prescription drugs internationally. This would encourage lower costs due to competition. Trump also wants to place an emphasis on enforcing current immigration laws to help relieve healthcare costs.

- Mike Pence, Trump’s running mate, voted against the Affordable Care Act and voted to repeal it. He has experience with the Healthy Indiana Plan, Indiana’s alternative to the Affordable Care Act’s expansion of Medicaid. Pence has spoken out in favor of repealing Obamacare and replacing it with something that is more consumer-driven.

Taxes

All businesses are affected in election years as a result of changing business tax plans. In this particular area, it’s important to note candidates’ policies for all size businesses and how they define each size. For example, on Clinton’s website, she clearly states that for the purpose of her business tax plan, “small business” means a business with one to five employees. Trump doesn’t define small and large businesses, but that is probably because his tax plan is the same for all businesses:

- Clinton’s plan for small businesses include a variety of perks for starting a small business, such as access to financing, streamlining licensing and quadrupling the start-up tax deduction to make starting a business easier and more affordable. For current small businesses with one to five employees, Clinton plans to create a new standard deduction for small businesses, much like individual filers.

- Trump focuses on a tax plan for current businesses that cuts taxes across the board. Whether you have a small or large business, the Trump Plan lowers the business tax rate from 35 percent to 15 percent. He also wants to eliminate the corporate alternative minimum tax.

Retirement

This isn’t one of the staple issues candidates address on their websites and in debates, but a recent Charles Schwab survey shows that maybe it should be. Seventy-seven percent of people consider the ability to save enough for retirement a major public policy issue. That’s why we’ve decided to address it here.

There are trends in the current market and changes that have been building over time when it comes to retirement. Whether you’re getting closer to retirement or have employees who are approaching retirement age, it’s good to be aware of these trends and changes so you can plan accordingly. In addition, we’ve included Clinton and Trump’s stances on Social Security, as that is one of the staple programs with significant impact on retirement for many Americans.

The first thing to note is that markets don’t like uncertainty, and election years are always uncertain times. That means you’re likely to see fluctuations in your retirement account. Don’t panic! History tells us this fluctuation is normal during election years, and it can even be profitable in the short term.

While both candidates have ambitious plans to improve the economy, neither one has any specific plans for retirement investments or how to save more for retirement. However, assuming a booming economy would result in having a great ability to spend and save, you could say both candidates have an indirect plan for improving retirement. Unfortunately, neither one has concrete plans.

There is one thing the next President of the United States will have the ability to do that will have an impact on savings. Low interest rates have been negatively impacting baby boomer’s retirement funds, and while the next president won’t be able to choose the interest rate, they will have the opportunity to influence it. Trump has mentioned that, as a developer, he loves low interest rates, but the fact that they have been so low for so long worries him. But remember, with an increase in interest rates comes a decrease in bond value.

Here’s what the candidates say:

- Clinton wants to leave Social Security alone. She has even mentioned expanding upon the current plan, with money from additional taxes on the wealthiest Americans. She is not in favor of increasing the retirement age for Social Security benefits.

- Trump also wants to keep Social Security the way it is. However, he has alluded to at least taking a look at the current program to see if there are ways to improve it. He is also against increasing the retirement age for Social Security benefits.

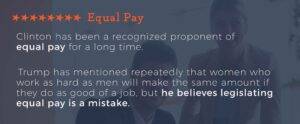

Equal Pay

As more and more of the workforce is made up of women, equal pay is getting more and more attention. The statistic that’s constantly thrown around is that women are only making 77 cents for every dollar men make. Does that statistic compare women and men with the exact same education, years of experience, job description and hours worked?

Regardless of the answer, celebrities are engaging in the conversation, and equal pay has become a hot button issue for many this election season. Both Clinton and Ivanka Trump have clearly stated that equal pay is a priority, but how will Clinton follow through to make it happen? And how does Ivanka’s father feel about equal pay? We’ve compiled some information below:

- Clinton has been a recognized proponent of equal pay for a long time. During her time as a New York Senator, she introduced a bill called the Paycheck Fairness Act, which would update the 1963 Equal Pay Act. This bill would require employers to document that any differences in pay are related to job function and not based on sex. Critiques of the bill include that it would make tying pay to performance more difficult.

- Trump has mentioned repeatedly that women who work as hard as men will make the same amount if they do as good of a job, but he believes legislating equal pay is a mistake. Trump’s daughter, Ivanka, made equal pay a platform during her speech at the Republican National Convention this year. According to her remarks, Trump “will fight for equal pay for equal work, and I will fight for this too, right alongside him.”

Paid Family Leave and Childcare

Coming along right beside the issue of equal pay are the issues of family leave and childcare become more and more popular. While this isn’t one of the traditional issues we’re used to hearing candidates talk about, this year both candidates have big plans for paid family leave and childcare. Since both of these affect business, we thought it was important to include, despite the fact that it might not be a top-of-mind issue:

- Clinton details a plan to offer 12 weeks of paid family and medical leave to care for a new child or a seriously ill family member, plus 12 weeks to recover from a serious injury or illness. Her goal is to provide at least two-thirds of an employees’ wages during this time off, funded by her tax increases on the wealthiest Americans. Her plan for childcare is a little less detailed, but she mentions the possibility of tax cuts for new parents or state grants for infants and toddlers.

- Trump’s plan is to offer six weeks of paid maternity leave through the unemployment insurance that companies are already required to carry. If your business already offers paid maternity leave, this plan would not apply. His detailed childcare plan includes incentives for businesses to offer on-site child care, tax deductions for childcare costs and the establishment of Dependent Care Savings Accounts (DCSA).

Bottom line? Neither of these candidates are currently proposing plans that will directly affect your finances, but it’s worth putting on your radar because depending upon your current policy, there may be some employees taking additional time off. Whether that means additional work coverage for the rest of your team, or hiring a temporary employee, it will have an effect on your workforce.

The Election and Beyond

Every election has some sort of impact on human resources and employee benefits, whether you realize it or not. The majority of Americans have a list of issues they vote on, and human resources and benefits aren’t always at the top of the list. They’re definitely worth exploring, though, especially during presidential elections. So if you’ve been wondering “How will Hillary winning affect human resources?” or “How will Trump affect human resources?” the answer is both will make an impact, and in many areas, the impact will be different.

While it’s easy to look at each of these issues individually and choose a candidate you believe is best for your business or your employment, it’s essential to look at their combined stances to get the big picture. For example, while a candidate may be in favor of raising the minimum wage, they may also be in favor of tax breaks for businesses that would help lessen the blow on businesses’ bottom lines. Is it enough? That’s for you to decide.

Every election has an impact on human resources and employee benefits, but some years, the impact is greater than others. Regardless of how you feel about each of these candidates and their stances as it relates to business, it’s important to educate yourself on their views so you can make an educated decision on Election Day.

The 2016 election will affect human resources. Just make sure you consider the candidate’s complete package before you head to the polls on November 8th. We hope you found the Triumph’s Election Special 2016: HR and Benefits helpful.

Corban OneSource is a Mid-Market Human Resources Outsourcer or HRO for companies of 75 to 6,000 employees. Are you looking to outsource the core HR functions of Payroll, Benefits Administration and HR Support?Find out more here.